In

India,

Algorithms that use Application Programming Interfaces (API) are the most commonly

used ones. Here, the

investor selects the strategy, which he then programmes and are executed by the

Broker.

Yes,

algo

trading is allowed in India and is legal. India introduced algo trading in 2008 with

SEBI opening the doors of

algo trading for institutional investors. With the evolution in algo trading, many

brokers have extended algo trading to

retail investors as well.

Algorithmic

Trading - Algorithmic Trading is the process of converting a trading strategy into

an algorithm or computer

code, and checking whether the strategy provides us with good returns by performing

backtesting on historical data.

Avoids human intervention, Maintain Accuracy over longer run

Beginners

can

use algo trading to successfully carry out trading activities without any hassles

and long trading hours.

Experts believe that future lies in algo trading and one can make good amount of

money through it.

It is

automating

the overall process of order executions like buying or selling and would often have

portfolio & risk

management automated as well..

Only

one in

five

day traders is profitable. Algorithmic trading improves these odds through better

strategy design,

testing, and execution.

We

offer a

fully

automated algorithmic trading system that can be auto-traded by one of registered

brokers. Absolutely

no experience is needed, since these algorithms are 100% automated.

The way it works is relatively simple. The algorithms are already loaded on the

broker’s trade servers, so there is no

setup required on your part and no need for you to stare at a chart all day waiting

for an email or text. The trades

automatically occur on your account and you will get a push telegram notification on

your phone letting you know a trade

was initiated, what is your stop/limit is, and much more.

Definitely!

In

fact, this is one of the benefits of automating your strategy.

Controlling the emotions, giving you the scalability, giving you the bandwidth that

you can use to work on the

strategies while execution is carried out by the machines are some of the key

benefits that you get by automating at any

scale.

Unless if you are interfering with your port all the time then nothing can help you

but assuming you are not doing that

then yes automation can help.

Quantitative

trading involves using advanced mathematical and statistical computations along with

quantitative analysis

to devise trading strategies. This can then be executed manually or in an automated

fashion, depending on the strategy

(and the strategist!)

- Knowledge of the programming language- Formulating complex algorithms requires extensive know-how of coding software such as C+, C++, Java, Python, R, etc. ...

- Dependence on technology - Faulty algorithms have the potential to result in insurmountable losses for the trader.

High

Frequency

Trading involves executing orders in an extremely short span of time, usually in a

sub second, and

targeting minuscule profit from each trade but doing a vast number of them overall.

HFT is a subset of Algorithmic

Trading and given the speed at which you’d need to send the orders, must be

automated. Interestingly, most of the HFT

strategies, except for plain vanilla arbitrage, are quite quantitative in nature.

From

the

recipient point of view if you are doing it manually and someone is out there doing

algo then the benefit to

you is the bid-ask rate and liquid market. In case you are on the other side where

you want to do your own trading using

algorithms, in that case, it gives you much more scale and the number of stocks on

which you can run each strategy on.

So instead of monitoring 5 to 10 stocks or 5 to 10 strategies that you can work on

manually, you can take and multiple

by 100s. Also, the emotional power and the analysis side can do a lot of wonders

with the algorithms even if you are not

doing the execution part with the algorithms.

Latency is

how

much time you are losing out when you are sending out an order. Basically, it is the

time taken by the

order to reach the trading destination or exchange or how much time it is taking to

process market data, order routing

and much more.

Latency helps you to identify the appropriate infrastructure will set up your own

desk. It also helps you to identify if

you should be picking up a momentum-based strategy or a market making strategy.

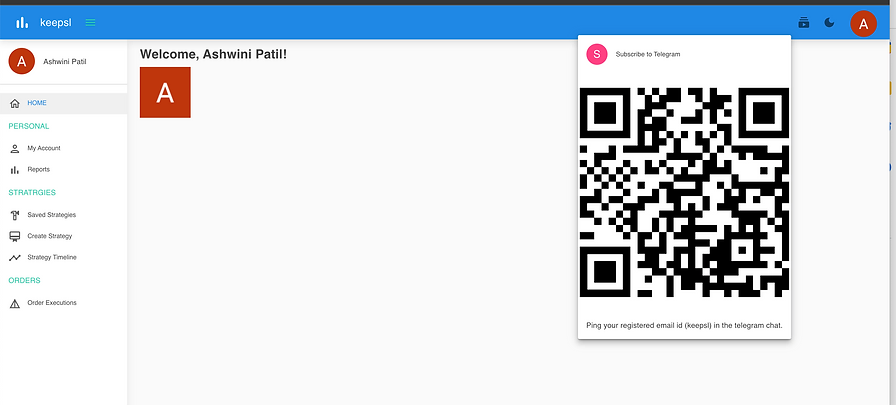

keepsl.com

is

platform where you can automate your trading strategies in realtime.

As of

now,

you

will not.

You

can

create

as many as you want, but based on the plan you have subcribed.

No,

broker

charges are separate. Its purely for algo subscription.

Yes.

The

algorithms are traded under a letter of direction, meaning you still have access to

your funds. There is no

holdout period, if you wish to stop, simply email the broker and let them know.

Yes,

you

cans.

No, It

will

be

handled by the code. It keep checking every thirty second to try to sell for SL

limit price. After 6

attempts, after that will close at available CMP ie by 9.18AM code will see if that

leg is open, it will exit.

Check

telegram

notification, If there is no notification, then check strategy configuration again

for its correctness.

Double ensure you have created the strategy correctly and have sufficient fund to

execute it.

Yes,

you

can.

Yes,

you

can

create your own strategies. Thats the advantage!!

Pl

login to

the

algo platform, there you can select the toggle button to turn it on or off any

particular strategy.

No,

its

only

MTM. It do not include any brokerage or STT etc.

Update

password

in UI. if you have updated.

Once

you

open

acct and the strategy is created in our platform, everything is fully automated. You

need not login to

your broker acct also. If you have sufficient capital, all will be done by algo. Sit

back and relax, just check your

telegram notifications to monitor.

Yes,

at the

end

of the day (EOD) you will be receiving the PnL statements in telegram with coloured

symbols. It's the

actual live profits made in all trading strategies in the user's account.

Its

based

on the

individual's created strategies. Follows risk per trade based on its own strategy

rules.

No,

all

strategies have independent strat Id. All are separate.

Yes,

as

needed.

This is included as part of the maintenance of the algorithms. If we find an

improvement to the existing

algorithms, we will provide that to our auto-execution brokers and do our best to

notify all existing customers of the

change. This tends to occur on a yearly basis, with new ideas being rolled out in

the first quarter of the new year.

No.

The

average

gain per month is an average gain that the algorithms have made in a simulated

account going back to the

period indicated. Some months they made more than what is posted, other months they

made less or posted losses for the

month. This is an average gain per month using the “per unit” trade size.

Results are based on simulated or hypothetical performance results that have certain

inherent limitations. Unlike the

results shown in an actual performance record, these results do not represent actual

trading. Also, because these trades

have not actually been executed, these results may have under- or over-compensated

for the impact, if any, of certain

market factors, such as lack of liquidity. Simulated or hypothetical trading

programs in general are also subject to the

fact that they are designed with the benefit of hindsight. No representation is

being made that any account will, or is

likely to, achieve profits or losses similar to these being shown.

Make

sure

strategy is enabled. Otherwise, algo will ignore the exit.

No.

-

If orders are not executed, please check below items -

- 1. Check account status - enabled/disabled. It must be enabled for orders to execute.

- 2. Check Order Execution Window - screen to verify if order is scheduled/rejected

- 3. Telegram notifications.

- 4. You can retry the failed legs by going to manual actions then open now then retry failed legs.

Ways to monitor your orders

-

1. Get telegram notifications by subscribing to telegram bot and pinging the

bot with the registered mail ID

Please check the fund status before execution of strategy. Make sure

sufficient fund available as per the broker/SEBI

guidelines.

Make sure sufficient funds are available at that point in time. Else,

telegram will throw error as Order rejected by

broker. API or Algo errors will set order leg status as FAILED in OEW and

Telegram notification will be sent. User need

to manually handle the failed orders.

Check the user configuration for Positional SL time. Is it AMO /9.18/9.30

Check under advanced, is MSLC enabled, If the broker exit the position before

the prices breaches as per the candle data

algo will not be aware of these SL order closure (Positive slippage scenario)

Check the filled price from OEW, It might be a positive slippage scenario,where

broker exit the leg before it breach the

SL limit value.

As of now no need to login every day with any of the brokers.

Algo will handle SL breach scenario in case of gap ups or gap downs, It checks

the Open orders and Square off in first 3

mins of the market open with 6 checks in every 30sec. If any SL breach happens

during spikes between 0915hrs to 1530

hrs, that SL breach needs to be handled manually.

Either price clash has done sq off by the broker/Broker UI bug. User can get

broker Order ID and filled price via OEW,

User can raise ticket with broker support.

Telegram bot subscription done? Check the OEW.

Check for the filled orders/price in OEW, Algo always calculates based on Avg

filled price. KeepSL P&L exclude brokerage

and taxes.

Enable exit partial strategy under advanced section in KeepSL UI.

It allows user to select the strategy execution day/Days before weekly expiry

which varies from 1-4days before monthly

expiry which varies from 1-28days

Verify whether broker account is blocked or not. Check fund balance, telegram

notifications, order Execution Window. if

still not able to resolve Please send us the screenshot of the rejected message.

When a suitable strike is not found, no order is placed. So it's not rejected by

broker, simply order is not placed as

no strike available to place any order.

That's why Telegram clearly says "ORDER NOT PLACED".

In this case, user needs to select min as 1 and max as 100, so algo will select the price closest to 100. If you select min as 80 and max as 100, there are chances that required price may not available within this range, it will be missed. ie Algo will skip this.

That's why Telegram clearly says "ORDER NOT PLACED".

In this case, user needs to select min as 1 and max as 100, so algo will select the price closest to 100. If you select min as 80 and max as 100, there are chances that required price may not available within this range, it will be missed. ie Algo will skip this.

For 8rs - it's MARKET order executed. Check candle for that time algo found

strike correctly but broker can fill at any

price as its market order.

Note:You can try LIMIT order but there is a risk of order not filling

price as its market order.

Note:You can try LIMIT order but there is a risk of order not filling

Yes, If you have enabled it before 0830h, it will take trades.

Expiry is Thursday, not affected because of Wednesday/Tue/Mon holiday. So algo

calculates relative to Thursday. So if

you have any strategy's entry_day as exp_day_before will not work in this case.

You need to change entry_day with

respect to to day.

When there is Price clash and order get squared off by the exchange, If any SL

orders for that strategy is open, which

needs to be cancelled manual. Algo will execute this order back if the price is

seen later anytime in the day.

Once you receive login fail message, Please go to my accounts section and then

select your account then press Verify and

update then only the login will be successful, and your orders will get executed

after you verify and update.

In this case, user needs to select min as 1 and max as 100, so algo will select

the price closest to 100. If you select

min as 80 and max as 100, there are chances that required price may not

available within this range, it will be missed.

Ie Algo will skip this.

If limit entry is missed, Algo will wait for 10 sec and move on, Any SL/Exit has

to be done by user end.

If your strategy says missed in OEW, you can try to re-enter by doing following

action

Go to Manual actions---Open Now----Select Strategy which is missed----Then

Click Run. Before doing this, check why

is it missed by clicking on Expand

No, it does not.

Open position need to be handled manual and PnL need to be updated manual. Algo

will not handle this case as SL order is

rejected by broker.

Please check whether you have paid for 4 leg or more, by default 4 legs payment

is processed, as you select 6 or 8,

payment for the same is different. No of legs won't affect your execution speed.

No, number of legs will not have any impact on execution speed.

Execute button strategy executes strategy instantly irrespective of the time

mentioned in the strategy. If you execute

it during non market hours, it will be executed as soon as the market opens the

very next day/trading session.

These

are

strategies where in you will execute orders based on certain conditions such as

Opening Range Breakout(ORB),

Moving Averages etc

1. Re-entry AT COST with tries more than once considers average price of all past

filled orders

2. Re-entry AT COST during wild market movements will take trade if price is not

more than 10% deviated from the cost.

3. RE-ENTRY will stop if any order is rejected by broker

4. If you want to stop further re-tries in RE- ENTRY. Either disable the strategy or

square off the strategy from KEEPSL

Platform. You should not square off using broker, algo won't be aware of this action

and re-entries will continue on

algo side.